Estimation application downloads and cost

Description

DizziPay is a revolutionary way to make mobile & desktop payments. DizziPay has developed a

unique, totally secure digital payments technology for consumers, Banks, issuers, sub-issuers which

supports mobile and online transactions. It is the world’s first solution that allows consumers to pay

securely with card, without owning a card.

Why You Prefer DizziPay?

DizziPay is the answer in terms of outperforming existing products for functionality, compatibility,

versatility and security.

- Dramatic reduction in manufacturing, distributing and managing plastic cards.

- Reducing dependency on the acquirer statistical fraud test.

- Significantly minimizing credit card fraud and identity theft.

- Dramatic reduction in customer support teams manpower.

DizziPay is compatible with all existing merchant systems, without any changes necessary on the

merchant side and/or the acquirer.

Leading-edge payment technology

Totally secured Digital payments

Everything without a plastic Card

Benefits for Consumers, Merchants & Card Issuers

Consumers can

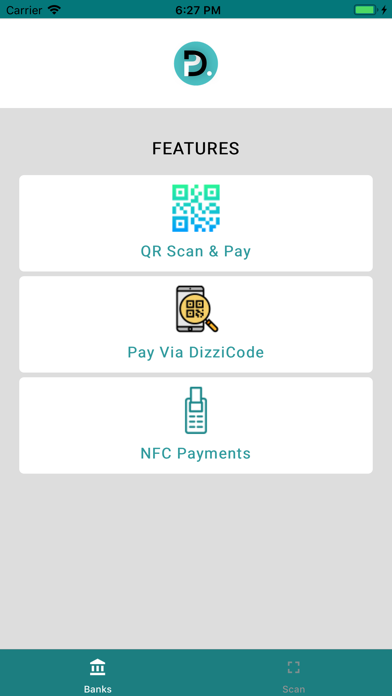

- Shop anywhere, face-to-face through NFC or online

- Be confident they are protected from fraud even if a merchant is hacked

- Avoid credit checks and contracts, simply by connecting through their mobile

- Use it whether or not they have a payment card

Merchants can

- Be confident there will be no fraud chargeback

- Have peace of mind that hacks will not lead to data loss

- Tap into an existing customer base of people unable to shop online until now

- Accept DizziPay without needing new hardware or software changes.

Card Issuers can

- Get access to a client base that wants to use cards, but does not have easy access to them

- Be protected from fraud, either face-to-face or e-commerce

- Avoid exposure to credit loss

- Reduce the cost of risk management

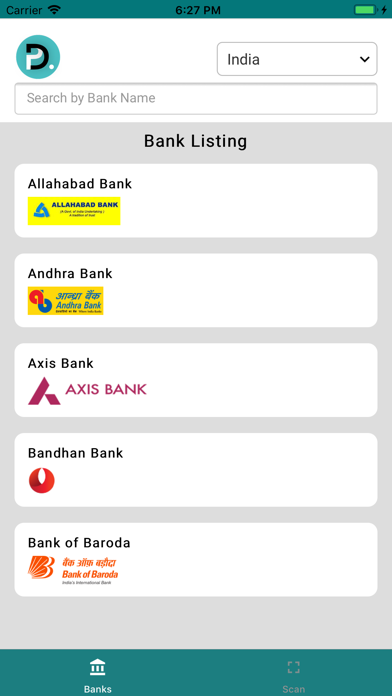

The product contains DizziPay ready-made Application API – Make your bank’s application support

cardless and virtual card transactions. Ready to be rebranded for the Bank.

DizziPay For Banks and Third-Party Processor companies-

Readymade plug and go play implementation that will allow any bank to empower it’s

noncard holding customers to make online or F2F brick and mortar purchases.

For the first time in the world, Banks can access to new customers who do not have access to

or choose not to have cards.

An additional product offer for existing customers.

Potential revenues from interchange fees on the trillions of US dollars spent on

payment cards each year.

Reduced fraud, credit losses and lower total cost of risk management.

How DizziPay benefits to Banks

Explore the newest & safest revenue streams available to make your presence in the market with no

access of credit cards. DizziPay puts forward numerous reasons for the banks to benefit in the best

possible ways.

Dramatic reduction in security software expenses.

Innovation – being a cutting-edge technology bank.

Significantly minimizing credit card fraud and identity theft.

Dramatic reduction in customer support teams manpower.

Increased Volume and Income with DizziPay- non- cardholders become your customers.

Increased Reputation and Trust- Improve trust and credibility with customers.

Enable Equal Opportunity- Connecting non card holder to the payment cycle.

Reducing Security & Risk Management- Costs Reducing F2F and ECOM fraud.

Technology and Innovation- Eliminating competitive risk.

For other queries/complaints related to DizziPay, please write to [email protected] or visit

www.dizzipay.com

Read more

unique, totally secure digital payments technology for consumers, Banks, issuers, sub-issuers which

supports mobile and online transactions. It is the world’s first solution that allows consumers to pay

securely with card, without owning a card.

Why You Prefer DizziPay?

DizziPay is the answer in terms of outperforming existing products for functionality, compatibility,

versatility and security.

- Dramatic reduction in manufacturing, distributing and managing plastic cards.

- Reducing dependency on the acquirer statistical fraud test.

- Significantly minimizing credit card fraud and identity theft.

- Dramatic reduction in customer support teams manpower.

DizziPay is compatible with all existing merchant systems, without any changes necessary on the

merchant side and/or the acquirer.

Leading-edge payment technology

Totally secured Digital payments

Everything without a plastic Card

Benefits for Consumers, Merchants & Card Issuers

Consumers can

- Shop anywhere, face-to-face through NFC or online

- Be confident they are protected from fraud even if a merchant is hacked

- Avoid credit checks and contracts, simply by connecting through their mobile

- Use it whether or not they have a payment card

Merchants can

- Be confident there will be no fraud chargeback

- Have peace of mind that hacks will not lead to data loss

- Tap into an existing customer base of people unable to shop online until now

- Accept DizziPay without needing new hardware or software changes.

Card Issuers can

- Get access to a client base that wants to use cards, but does not have easy access to them

- Be protected from fraud, either face-to-face or e-commerce

- Avoid exposure to credit loss

- Reduce the cost of risk management

The product contains DizziPay ready-made Application API – Make your bank’s application support

cardless and virtual card transactions. Ready to be rebranded for the Bank.

DizziPay For Banks and Third-Party Processor companies-

Readymade plug and go play implementation that will allow any bank to empower it’s

noncard holding customers to make online or F2F brick and mortar purchases.

For the first time in the world, Banks can access to new customers who do not have access to

or choose not to have cards.

An additional product offer for existing customers.

Potential revenues from interchange fees on the trillions of US dollars spent on

payment cards each year.

Reduced fraud, credit losses and lower total cost of risk management.

How DizziPay benefits to Banks

Explore the newest & safest revenue streams available to make your presence in the market with no

access of credit cards. DizziPay puts forward numerous reasons for the banks to benefit in the best

possible ways.

Dramatic reduction in security software expenses.

Innovation – being a cutting-edge technology bank.

Significantly minimizing credit card fraud and identity theft.

Dramatic reduction in customer support teams manpower.

Increased Volume and Income with DizziPay- non- cardholders become your customers.

Increased Reputation and Trust- Improve trust and credibility with customers.

Enable Equal Opportunity- Connecting non card holder to the payment cycle.

Reducing Security & Risk Management- Costs Reducing F2F and ECOM fraud.

Technology and Innovation- Eliminating competitive risk.

For other queries/complaints related to DizziPay, please write to [email protected] or visit

www.dizzipay.com

ASO analyse DizziPay app for iPhone and iPad

No search terms founded